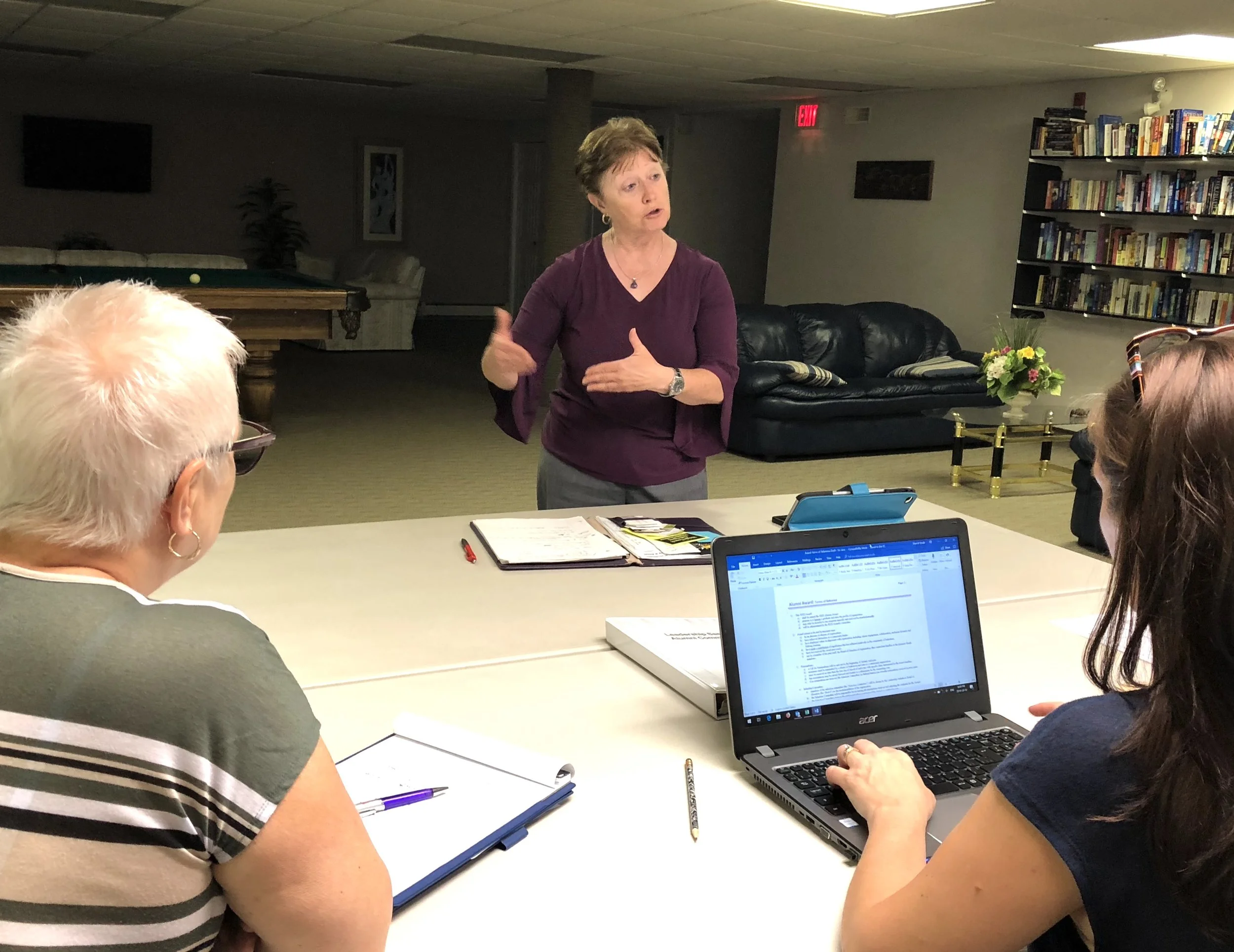

One of the speakers at the Power UP Your Retirement Lifestyle Seminar is Karla Amaya with Sunset Travel.

Karla will be speaking on how to travel smart:

importance of making a bucket list and setting your travel goals

travel budgets

the planning process

safe and low budget tour companies for single travelers

travel insurance

immunizations and

multigenerational travel

Meet Karla: https://youtu.be/aRL9AHu4rRw

Tickets: Advance $39.99 plus GST; at the door $45 plus GST.

For more information and tickets visit https://www.powerupyourretirement.com/retirementseminar

Retirement planning is more than just financial. Start planning today for a meaningful and fulfilling retired life.